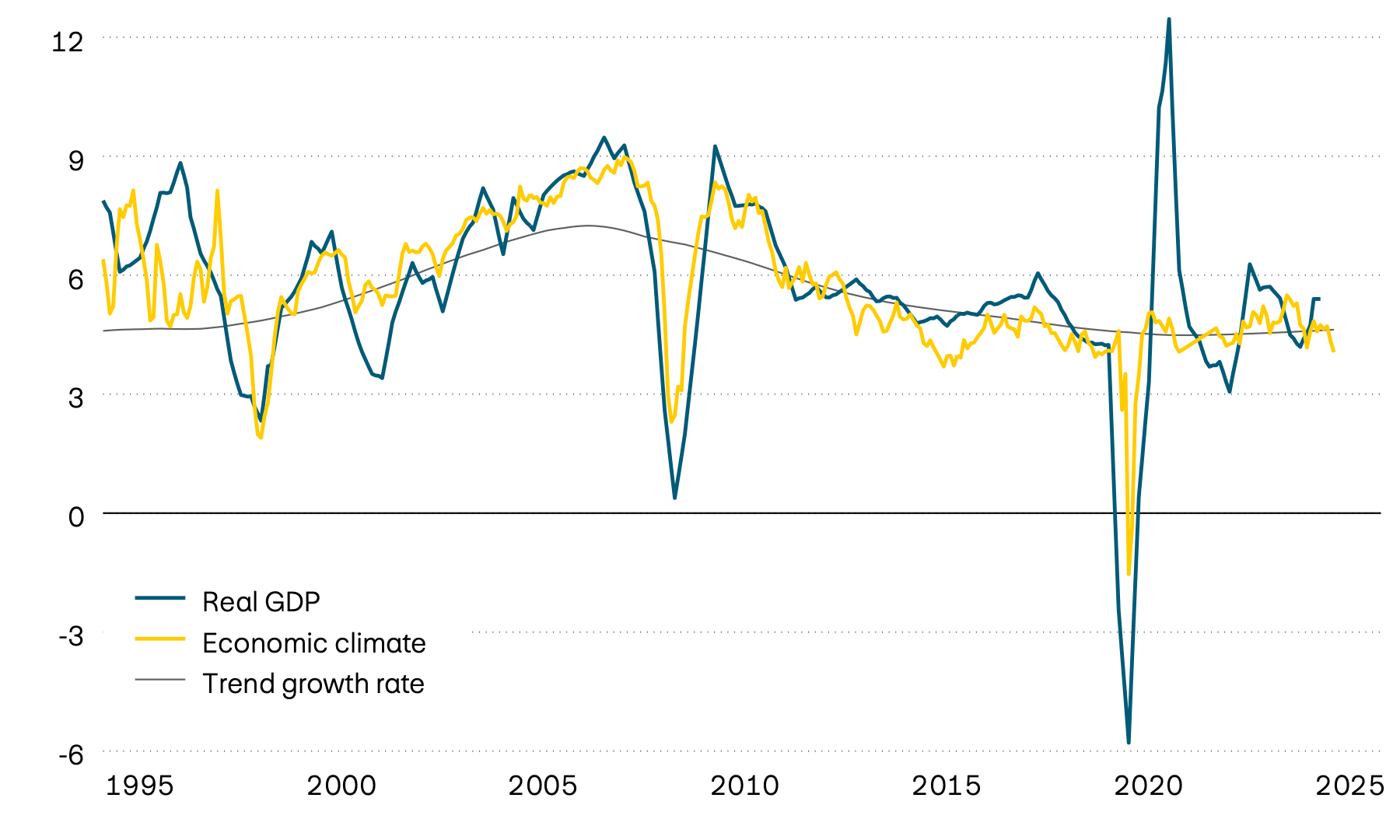

According to initial estimates by the State Secretariat for Economic Affairs (SECO), the Swiss economy grew by 0.5 percent in the first quarter. This growth was driven mainly by orders and deliveries to the USA being brought forward in an effort to pre-empt the tariffs already announced. The Swiss retail sector also benefited from the global increase in trading volumes, as many companies around the world responded in the same way. However, a countermove is expected in the current second quarter. Sentiment in industry, for example, has recently deteriorated significantly in light of low order volumes. At the same time, the domestic economy is showing some signs of weakness.

You are here:

Economy: Strained confidence

What is your view of the current economic situation? And what are your expectations for the future? In recent months, companies and consumers in many countries have responded to these questions with increasing scepticism. Confidence is being strained by ongoing uncertainties, in particular due to US tariff policy, and the slowdown in the global economy. So far, this mood has not yet translated into significantly lower investment by companies or any appreciable fall in consumer spending. It’s clear, however, that no major leaps in growth are possible in such an environment.

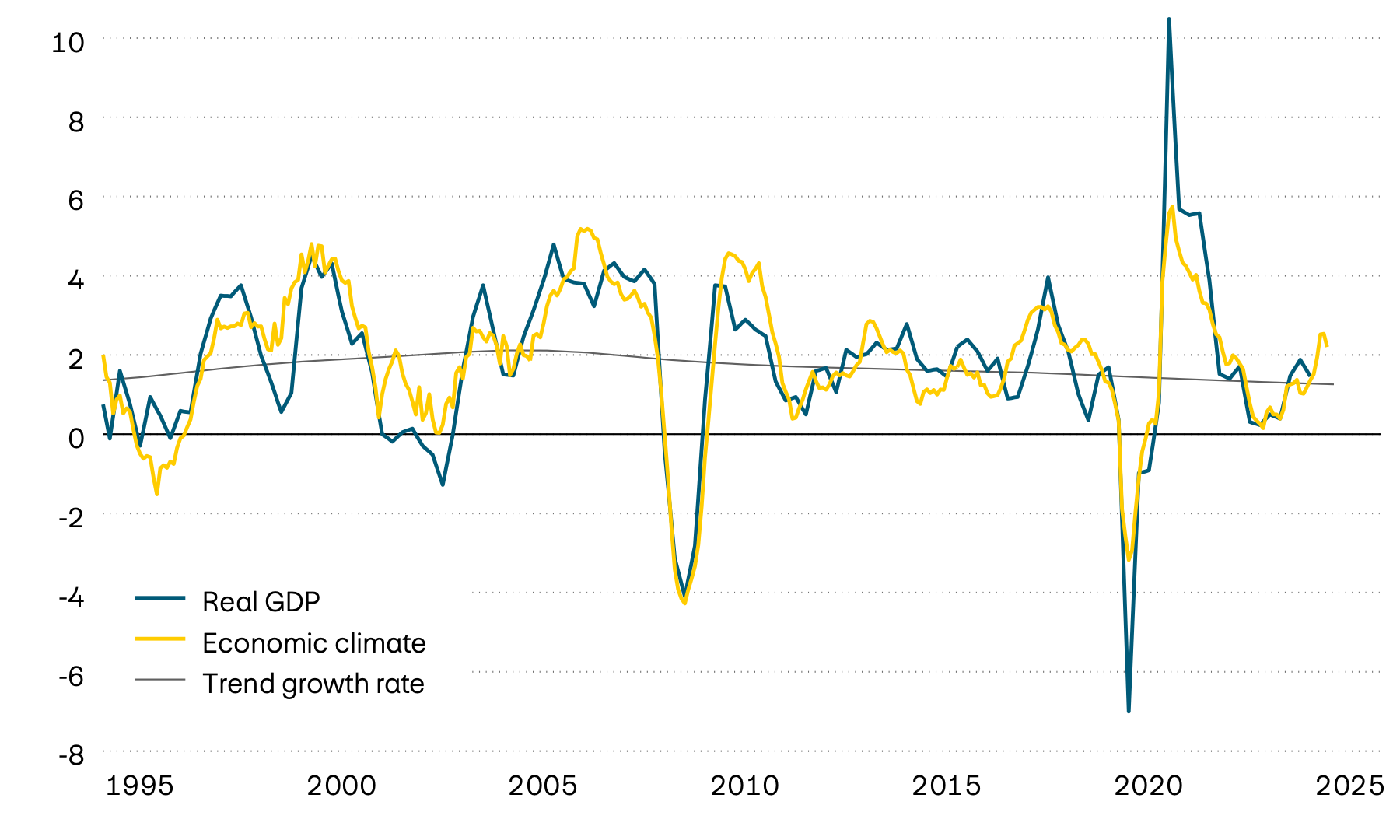

Growth, sentiment and trend

In percent

In the US economy, sentiment figures deteriorated across the board last month, most notably in the significant downturn affecting service and construction companies, which points to an expected sharp decline in demand in the coming months. This is likely due in part to the extremely pessimistic mood among American consumers at present, with sentiment figures currently at the second lowest level ever recorded. On a positive note, although figures for the real economy are weaker, they remain at their long-term trend level. There hasn’t been any significant reduction in consumer spending or investment as yet. Similarly, the labour market is showing no signs of weakness so far. However, it seems unlikely that the dip in sentiment will fail to have an impact on the real economy. The tax reform passed by President Trump is also likely to provide only limited economic stimulus.

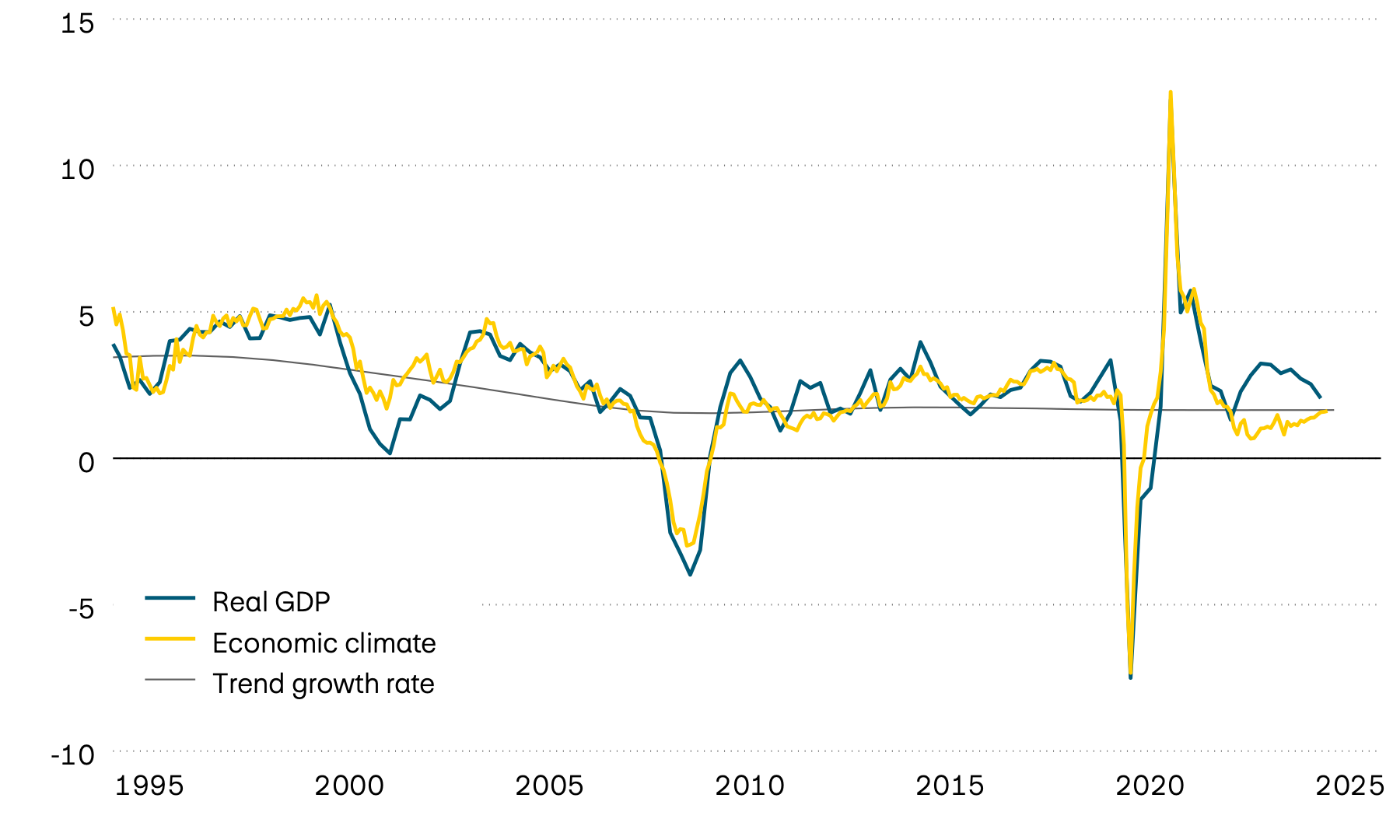

Growth, sentiment and trend

In percent

After a modest recovery over the last two quarters, the eurozone economy again appears to be losing some momentum. The signals from the domestic economy, in particular, have been weaker recently. For example, sentiment figures in the service sector have weakened continuously, while retail sales growth has slowed. Against this backdrop, the significant decline in inflation comes as no surprise. Core inflation has recently fallen in light of easing price pressure in the services sector, moving closer to the European Central Bank’s (ECB) targets. In June, the ECB responded by lowering its policy rate for the eighth time in a row, setting it at 2.15 percent in order to continue to curb inflation.

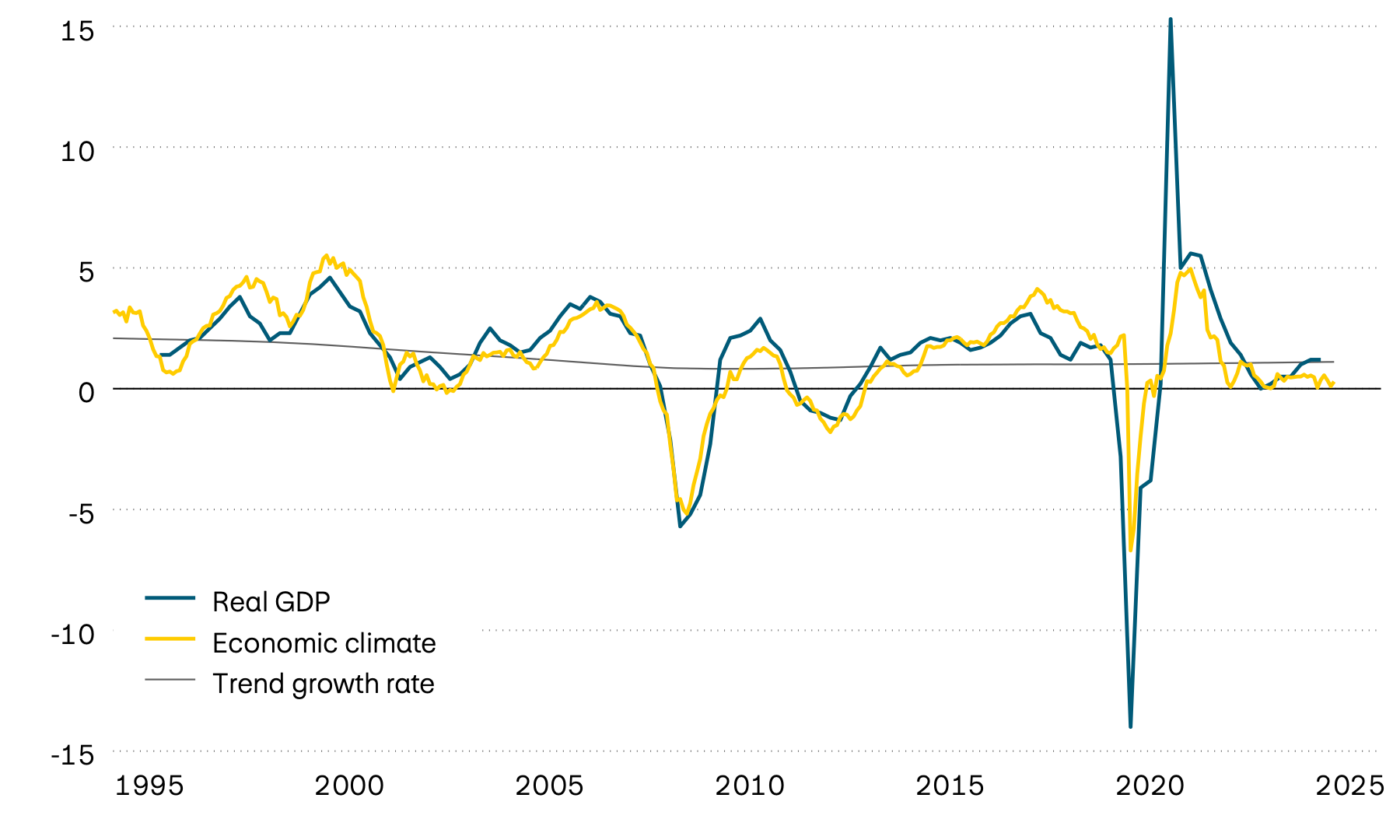

Growth, sentiment and trend

In percent

Economic performance in the emerging markets continues to vary from region to region. While India remains the engine of growth, both Brazil and Indonesia are also recording solid economic growth. However, overall performance is still being dampened by China, the biggest emerging market economy by some margin, and the second largest economy in the world. The country is suffering from an ongoing real estate crisis that is significantly hampering both investment volumes and consumer spending. In addition, there are the ongoing trade tensions with the USA. Although tariffs on exports to the USA have been reduced from an enormous 145 percent to 30 percent, they remain high. Against this backdrop, the Chinese government’s growth target of 5 percent for 2025 as a whole would appear difficult to achieve.

Growth, sentiment and trend

In percent

Global economic data

| Indicators | Switzerland | USA | Eurozone | UK | Japan | India | Brazil | China |

|---|---|---|---|---|---|---|---|---|

| Indicators GDP Y/Y 2025Q1 |

Switzerland 2.0% |

USA 2.1% |

Eurozone 1.5% |

UK 1.3% |

Japan 1.7% |

India 7.4% |

Brazil 2.9% |

China 5.4% |

| Indicators GDP Y/Y 2024Q4 |

Switzerland 1.6% |

USA 2.5% |

Eurozone 1.2% |

UK 1.5% |

Japan 1.4% |

India 6.4% |

Brazil 3.6% |

China 5.4% |

| Indicators Economic climate |

Switzerland + |

USA – |

Eurozone – |

UK – |

Japan + |

India + |

Brazil – |

China – |

| Indicators Trend growth |

Switzerland 1.3% |

USA 1.6% |

Eurozone 0.8% |

UK 1.8% |

Japan 1.1% |

India 5.3% |

Brazil 1.8% |

China 3.7% |

| Indicators Inflation |

Switzerland -0.1% |

USA 2.4% |

Eurozone 1.9% |

UK 3.4% |

Japan 3.7% |

India 2.8% |

Brazil 5.3% |

China -0.1% |

| Indicators Policy rates |

Switzerland 0.0% |

USA 4.5% |

Eurozone 2.15% |

UK 4.25% |

Japan 0.5% |

India 5.5% |

Brazil 15.0% |

China 3.0% |

Source: Bloomberg