Swiss mortgage interest rate forecast

Our assessment of the mortgage market

You are here:

How will mortgage interest rates develop over the coming months? Find out how our experts view developments on the mortgage and real estate markets.

Status as at: 11.12.2025

Editorial deadline: 11.12.2025

- The Swiss National Bank (SNB) left its policy rate unchanged on 11 December.

- Given the challenging economic environment and low inflation , the SNB’s monetary policy is likely to remain expansionary over the medium term.

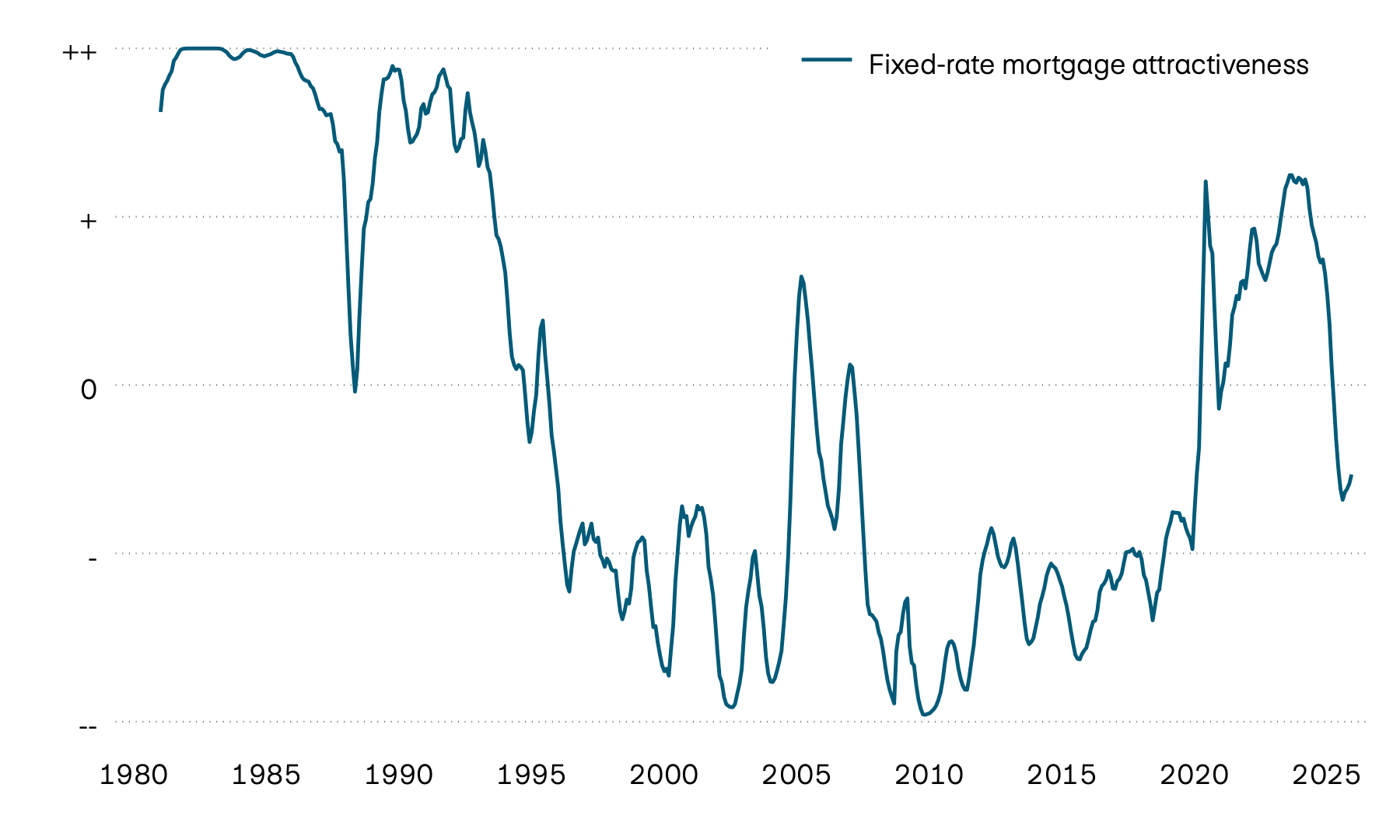

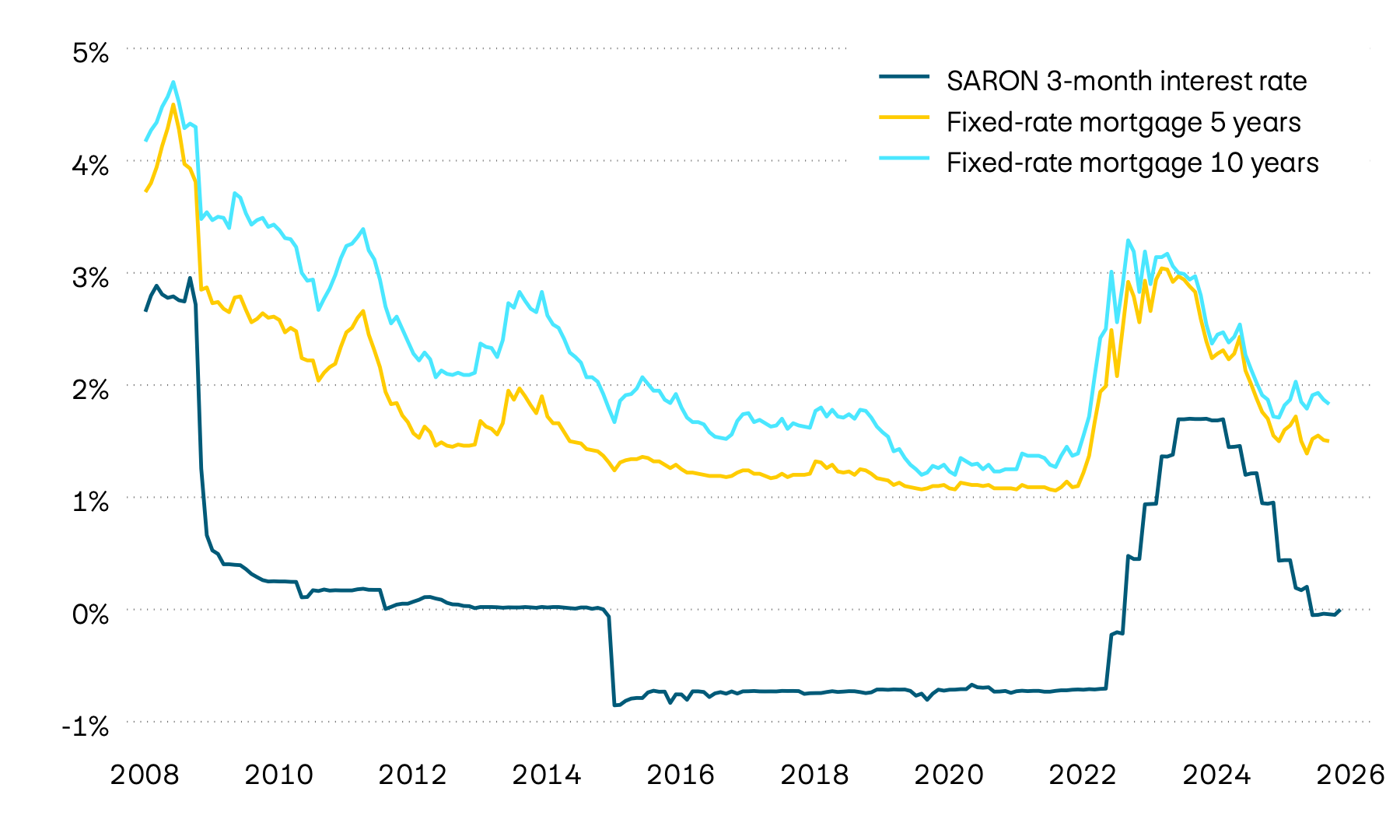

- Saron mortgages therefore offer attractive financing options. Fixed-rate mortgages also remain extremely attractive.

Current economic situation in Switzerland

The Swiss economy has suffered a significant setback recently, shrinking by 0.5 percent in the third quarter. Several factors are currently weighing on the economic environment. On the one hand, the high US export tariffs of 39 percent had a huge impact on the industrial sector. These have now been reduced to 15 percent with retroactive effect to 14 November 2025. The manufacturing sector in particular has lost significant momentum due to the tariffs.

Our interest rate forecast at a glance

| Forecast for | 3 months | 6 months | 12 months |

|---|---|---|---|

| Forecast for Saron |

3 months |

6 months |

12 months |

| Forecast for 5-year fixed-rate mortgae |

3 months |

6 months |

12 months |

| Forecast for 7-year fixed-rate mortgage |

3 months |

6 months |

12 months |

| Forecast for 10-year fixed-rate mortgage |

3 months |

6 months |

12 months |

As there are currently no signs of a rapid economic recovery and inflation could even fall into negative territory next year and, in turn, below the Swiss National Bank’s targets, pressure on the SNB to return to negative interest rates again in the medium term remains high.

However, the impact on owners is likely to remain limited if monetary policy is eased further. Saron mortgages usually have a floor of zero percent and the interest rate to be paid does not fall even if the policy rate falls below this limit. Furthermore, interest rates on medium and long-term mortgages are already at a very low level, which means that further downside potential is greatly limited.

Mortgage interest rates in Switzerland were still above 3 percent just 3 years ago. This was mainly due to the Swiss National Bank’s more restrictive monetary policy, which was a response to higher inflation in the wake of the coronavirus pandemic. In this environment, the SNB raised its policy rates to 1.75 percent. However, inflation in Switzerland is now under control again and there is even a threat of negative inflation rates. Monetary policy is therefore once again operating in a low interest rate environment. Mortgage interest rates have also fallen sharply and are now back at levels last seen when negative interest rates were introduced. We expect this level of mortgage interest rates to remain largely unchanged over the next 12 months. We expect the three-month Saron to be lowered in about 6 months. This means monetary policy is likely to remain unchanged at the next assessment on 19 March 2026.

In percent

Single-family homes and condominiums

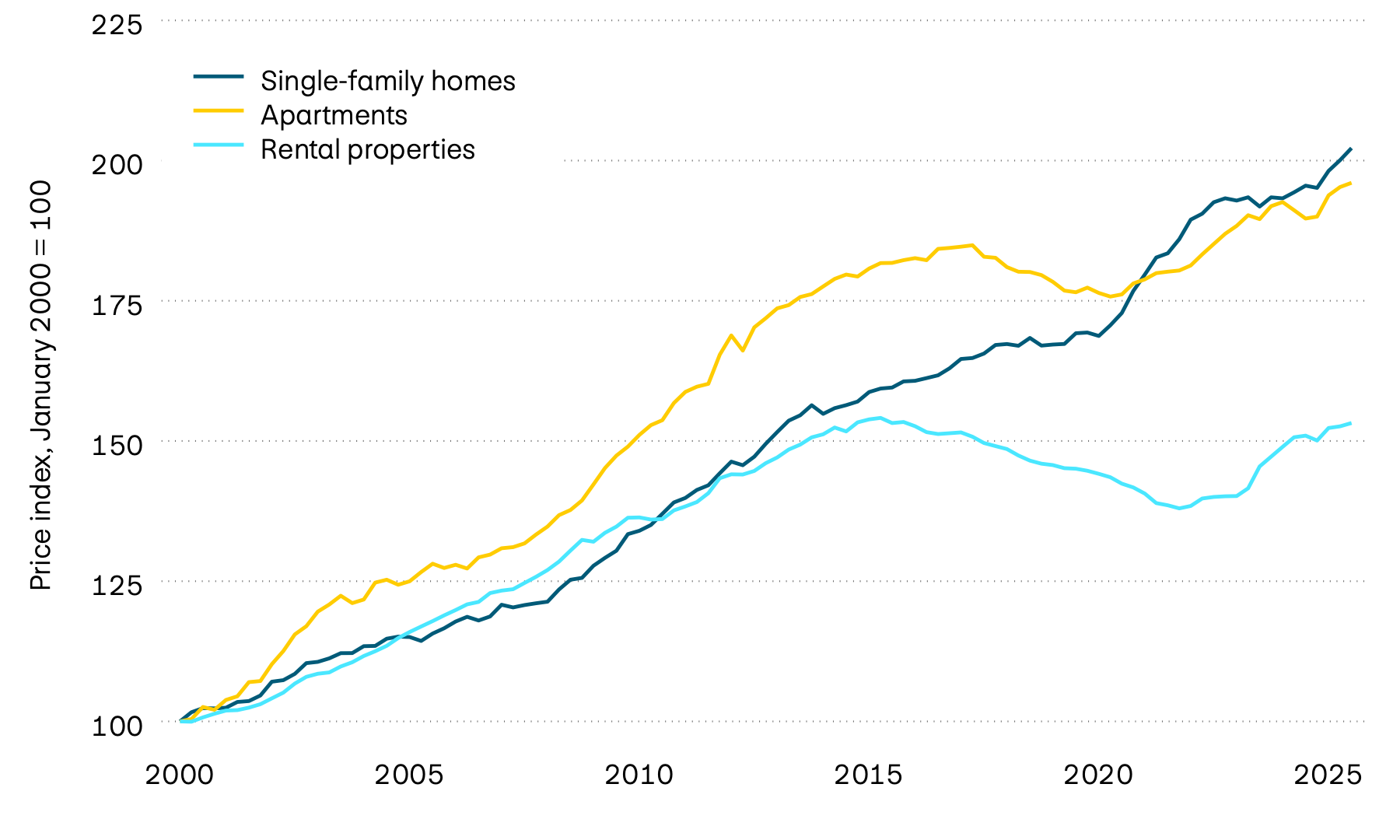

Real estate prices rose again in the third quarter. The prices of single-family homes rose particularly sharply. This strong increase is likely to be due to continued low capital market interest rates and persistent strong demand combined with tight supply. By contrast, the trend for rental apartments remains comparatively subdued. The reduction in the reference interest rate in March is likely to have an impact on this. Given the further reduction in September 2025, this subdued trend is expected to continue in the coming year.

Price index, January 2000 = 100

Interested in real estate as an investment opportunity? In our Investment compass under “Market overview”, you will find an analysis of the current situation on the Swiss real estate market.

What our experts say

“Persistently low interest rates and strong demand amid limited supply continue to drive property prices higher. Saron mortgages remain a particularly cost-effective financing option.“

Receive our assessment directly by e-mail after each SNB decision.

Fixed-rate mortgage or Saron mortgage?

Which is the right mortgage for me?

Gain an overview of the conditions for the fixed-rate mortgage and the Saron mortgage with our mortgage comparison.

| Indicators | Q1 2025 | Q2 2025 | Q3 2025 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Indicators GDP growth |

Q1 2025 2,5% |

Q2 2025 1,3% |

Q3 2025 0,5% |

2024 1,3% |

2025 1,0% |

2026 1,0% |

| Indicators Inflation |

Q1 2025 0,4% |

Q2 2025 0,0% |

Q3 2025 0,2% |

2024 1,1% |

2025 0,2% |

2026 0,3% |

| Indicators Unemployment |

Q1 2025 2,9% |

Q2 2025 2,7% |

Q3 2025 2,8% |

2024 2,5% |

2025 3,1% |

2026 2,7% |

| Indicators Net immigration |

Q1 2025 23‘000 |

Q2 2025 16‘000 |

Q3 2025 17‘000 |

2024 90‘000 |

2025 70‘000 |

2026 65‘000 |

| Indicators EUR/CHF exchange rate |

Q1 2025 0,96 |

Q2 2025 0,94 |

Q3 2025 0,94 |

2024 0,95 |

2025 0,94 |

2026 0,92 |

Source: Bloomberg, Allfunds Tech Solutions, BfS

-

Forecasting is a well-founded assessment, not a certainty. Whether now is the right time for you very much depends on your personal risk appetite, your financial situation and your individual needs.

If interest rates are falling: if you expect interest rates to continue to fall, a Saron mortgage may be an attractive option to benefit from the cuts, depending on the interest rate level.

If interest rates are rising: if you are expecting an interest rate rise or budget security is very important for you, it may be a good idea to fix the conditions over the long term with a fixed-rate mortgage.

Our specialists will be happy to help you find the right strategy.

-

The SNB policy rate can affect mortgage interest rates. This usually happens quickly with variable models such as the Saron mortgage, as these are based directly on short-term money market rates. Fixed-rate mortgages, however, are driven more by long-term capital market interest rates (swap rates) which to some extent already take into account anticipated future monetary policy and inflation. If a policy rate change is expected by the markets, its effect on fixed-rate mortgages could in many cases already be reflected in the interest rates beforehand.

-

Choosing the term is a strategic decision. Long terms (7–10 years or more) provide you with interest rate security over a long period of time, but are often slightly more expensive. Shorter terms (2–5 years) are usually cheaper, but require you to address the interest rate situation again sooner. Splitting is a popular strategy: you can split your mortgage into several tranches with different terms if required. This spreads the interest rate risk and avoids having to renew the total amount at once at potentially unfavourable conditions.

-

Saron mortgages are likely to continue trending sideways. The further policy rate cut expected next year is also unlikely to change this as Saron mortgages typically hit their low point at a policy rate of zero.

-

The right mortgage for you depends greatly on your personal risk appetite, your financial situation and your individual needs. Our specialists will be happy to help you find the right strategy for you.

-

Our interest rate forecasts are produced by our economists on the basis of in-depth analyses of the global and national economic situation, inflation trends and the monetary policy of central banks. They represent a likely development. However, ongoing or unforeseen economic or political events can have an impact on interest rate developments at any time. Forecasts should therefore always be seen as a guide and not a guarantee.

-

Prices are mainly influenced by supply and demand. Low mortgage interest rates can generally boost demand for home ownership, as financing costs fall. This can lead to stable or rising real estate prices. Conversely, if interest rates rise sharply, this can dampen demand – but it doesn’t have to, especially if supply remains tight. Political decisions on mortgage lending can also influence demand for residential property and therefore property prices.

-

Yes, that is possible. With a forward mortgage, you can secure the current interest rates today – even if your existing mortgage is not set to expire for several months (e.g. in six, 12 or up to 18 months). Depending on the lead time, requested term and market situation, an interest rate premium (forward premium) may be incurred. In return you will be protected against any interest rate rises until your current mortgage expires. Please contact us for a non-binding quotation.

This document and the information and statements it contains are for information purposes only and do not constitute either an invitation to tender, a solicitation, an offer or a recommendation to buy the related products. The customer or third parties are responsible for their own actions and bear sole responsibility for compliance with legal and regulatory provisions and guidelines. PostFinance has used sources considered reliable and credible. However, PostFinance cannot guarantee that this information is correct, accurate, reliable, up to date or complete and excludes any liability to the extent permitted by law. Information on interest rates and prices is up to date, but the actual development may deviate from these forecasts at any time. The content of this document is based on various assumptions. This means that the information and opinions are not a fixed basis for your financing decision. We recommend consulting an expert before making decisions.

Full or partial reproduction is not permitted without the prior written consent of PostFinance.

Interest rate forecast for download

-

Interest rate forecast for PostFinance mortgages, december 2025 (PDF) The link will open in a new window

-

Interest rate forecast for PostFinance mortgages, september 2025 (PDF) The link will open in a new window

-

Interest rate forecast for PostFinance mortgages, june 2025 (PDF) The link will open in a new window