valid from 16.12.2025

You are here:

Model portfolios – Swiss focus

Christmas rally with setbacks

Market sentiment improved somewhat again last month. The technology sector was able to recoup a large part of the losses it had suffered at the beginning of November. Nevertheless, this month has shown once again that the high expectations placed on the technology sector are difficult to meet. In recent weeks, this has led to increased price setbacks. Global value stocks continue to pay off in comparison.

We still see potential in emerging markets. The US dollar remains overvalued on a trade-weighted basis and should therefore support both equities and bonds in emerging markets. In addition, despite the increasingly difficult economic situation in Switzerland, we are maintaining our overweight position in Swiss real estate. Swiss real estate continues to offer attractive distribution yields, especially in comparison to money market investments.

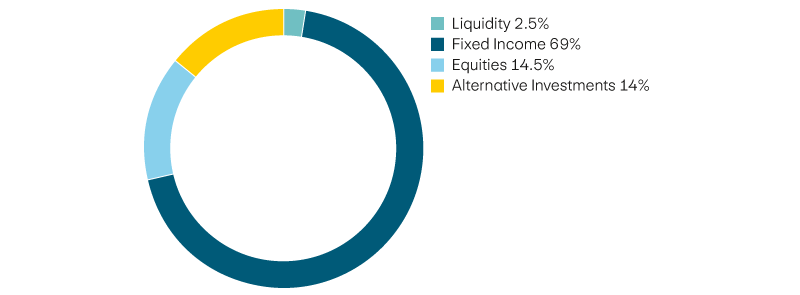

Interest income

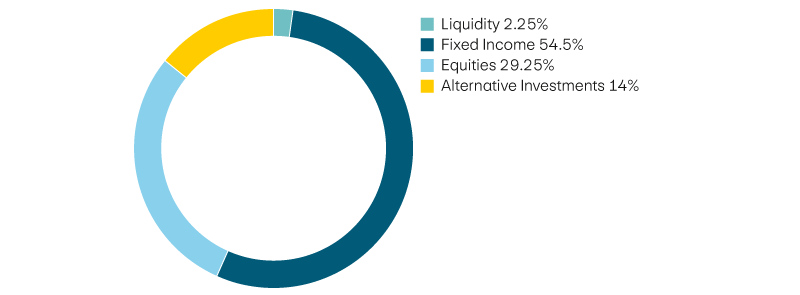

Income

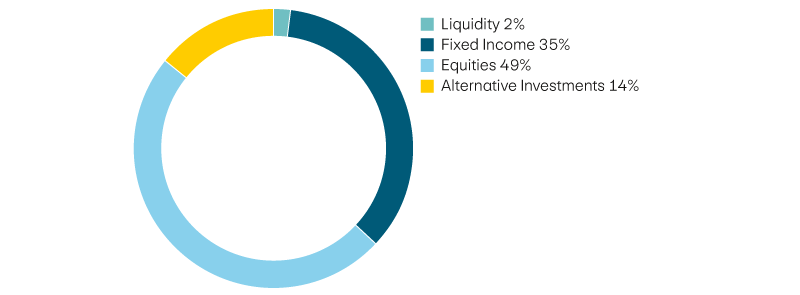

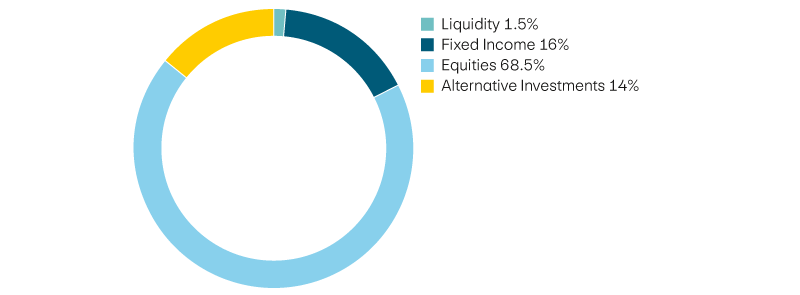

Balanced

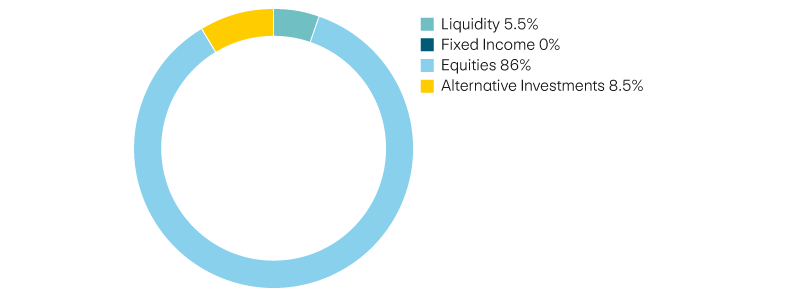

Growth

Capital gains