Learn how to open the investment solution "investment consulting plus" online and get an overview of the most important functions:

Investment consulting plus

We advise, you decide

You are here:

Want to keep up to date with market changes and get advice on your investment decisions? With the investment consulting plus package, you will receive personalized and comprehensive advice, which will enable you to make your own informed investment decisions.

Investment consulting plus: with a personal investment consultant

-

Choice of investment focus: Switzerland, Global or Responsible

-

Ongoing portfolio monitoring according to your individual investment strategy

-

An attractive range of funds and exchange traded funds (ETFs)

-

Automatic notifications for strategy deviations

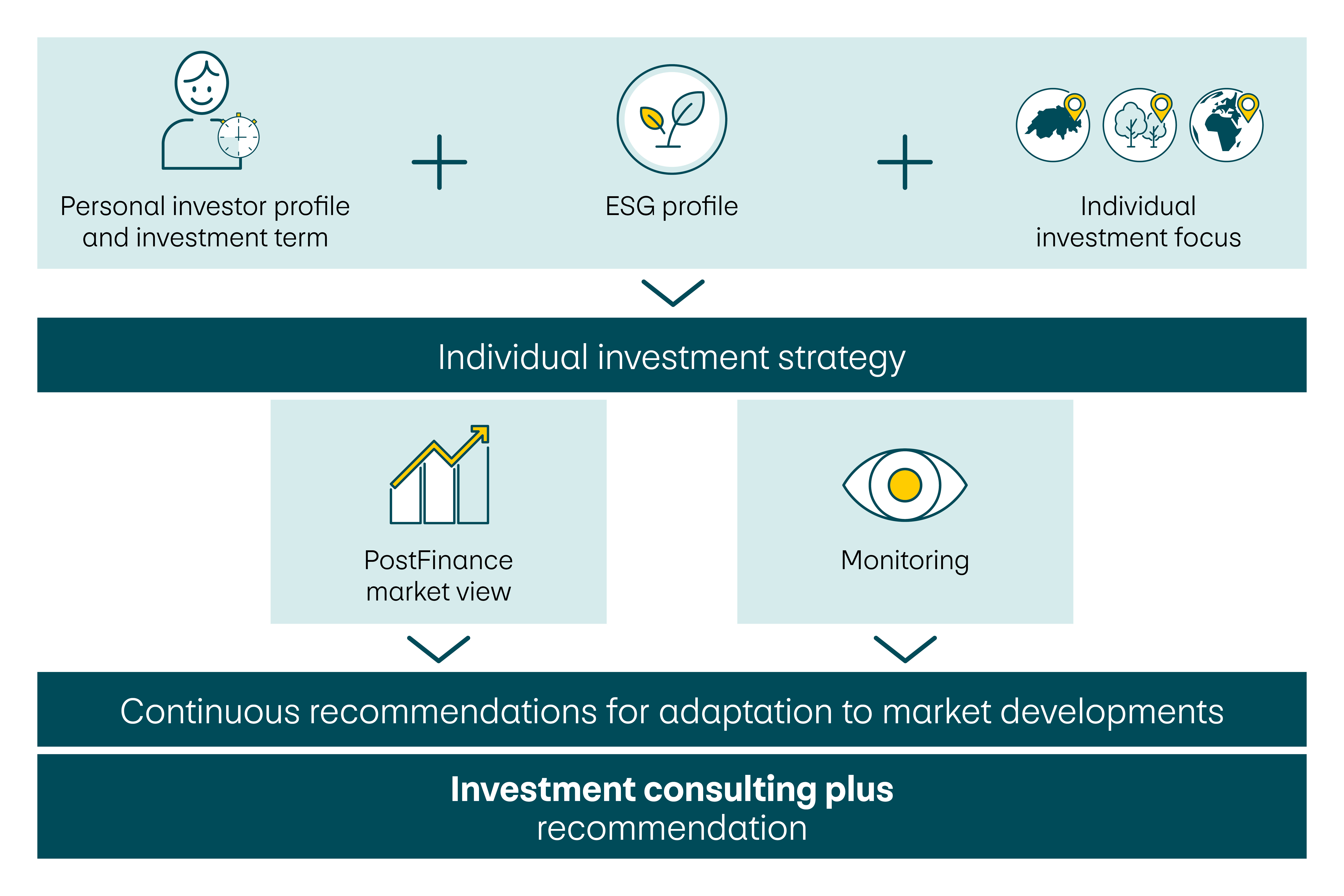

Based on your personal investor and ESG profile, your investment term and your chosen investment focus, we propose an individual investment strategy for you. This sets out and defines the ratio of different asset classes (liquidity, bonds, equities, alternative investments) and the ranges (bandwidths) within which they can move.

You choose an individual investment focus (Switzerland, Global, Responsible) to reflect your personal preferences in your portfolio. Through the ESG profiling process, you determine whether and to what extent we should invest in responsible and sustainable instruments for you.

Our market view is incorporated into your e-asset management based on current market developments and your investment strategy. You can rely on our investment experts to monitor and implement your investment strategy. From analysing the market environment to investing in our investment universe: our structured investment process ensures that your portfolio is always invested optimally and in accordance with your individual investment strategy.

Consulting and services

You will benefit from ongoing support from your personal investment advisor as well as new investment and reallocation proposals. Our investment experts provide you with investment proposals in line with your chosen investment strategy that you can also tailor to your needs. If there is any deviation from your chosen investment strategy, you will be notified automatically on the following day so that you can update your portfolio directly, if required.

In your e-finance, you also have the option of viewing your portfolio and checking on performance at any time and, if necessary, adapting your investment strategy or the chosen investment focus, and executing transactions.

Our market view

The PostFinance investment committee analyses current market activities in detail to define the positioning of the model portfolios. The proposed adjustments to reflect market developments will be sent to you via a notification in e-finance as soon as there is need for action. We ensure that any decision we make is in our customers’ interests, and we convey our positioning transparently in our monthly publication investment compass.

Investment is a personal matter. Set your own personal priorities and choose your individual investment focus: Swiss, Global or Responsible:

Swiss: a portfolio with a strong domestic focus

If you set your focus to the domestic market without neglecting diversification, you will benefit predominantly from the development of the Swiss market.

Global: the best the world has to offer

If you opt for a diversified global investment, you will benefit from differing economic cycles, interest rate levels and currencies.

Responsible: identify opportunities and minimize risks with ESG

Take account of environmental, social, and governance (ESG) criteria relating to the environment, society and responsible corporate management.

- Responsible focus (PDF) The link will open in a new window

- ESG report Focus Responsible (PDF) The link will open in a new window

- SCS (Suisse Climate Scores Report) Focus Responsible (PDF) The link will open in a new window

- “Responsible” focus in e-asset management and investment consulting plus (PDF) The link will open in a new window

Further information on the investment process

In the video, find out how our market view is formed and incorporated into investment consulting plus in line with your investment strategy.

By carefully selecting and systematically checking each investment instrument, we provide you with an attractive investment universe. When selecting these instruments, we only consider actively and passively managed funds with no sales remuneration, as well as exchange traded funds (ETFs).

Service fee |

0.90% p.a. on the average investment assets incl. investment account (minimum fee CHF 720 p.a.) |

|---|---|

For higher invested assets, the service fees are lower |

0.90% from CHF 0 (minimum fee CHF 720 p.a.) |

Sales remuneration |

None |

Investment amount (initial investment) |

Recommended minimum investment amount CHF 80,000, possible from CHF 5,000 |

Minimum amount (follow-up investment and redemption) |

From CHF 0 |

Transaction fees, further price items and information on the fees

Advice about financial investments

Get more from your money. Find the right financial investment in a consultation with our experts.